If you want a lie repeated, keep it simple. Of course, we use a little more coding to blame poor brown people these days. Spoiler alert: Instead of supplementing falling wages with credit, how about...

After all, it was a. Democrat Congress that relaxed the lending rules. I'm sure that didn't impact growth at all.

It was over 20 years of government intervention weakening lending standards that led us the edge of the cliff.

“the government subsidized and, in some cases, mandated the extension of credit to high-risk borrowers, propagating risks for financial firms, the mortgage market, taxpayers, and ultimately the financial system.”

They manage to repeat a nonsense meme without any data or facts to support their position.

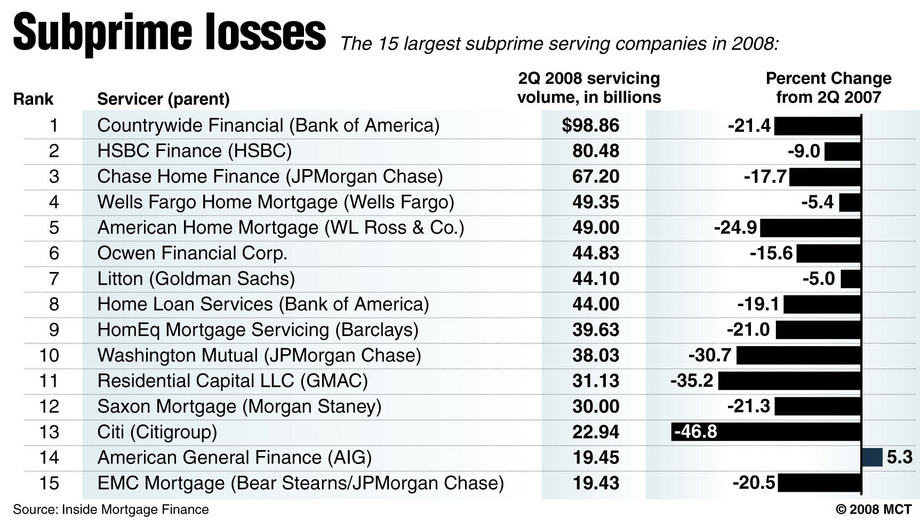

And as the table above shows, these were primarily non bank lenders not covered by the govt, or Schumer, or Barney Frank — pure unregulated private sector foolishness. .

Consider these commenters busted to buck private. They should be washing the latrines with a toothbrush

Only one of the top 25 subprime lenders in 2006 was directly subject to the housing law that’s being lambasted by conservative critics.

|

|

Discussing:

- Small dam in Walland to be removed (2 replies)

- Embarrassed? (1 reply)

- Feds looking for West Knox detention location? (6 replies)

- Search for Mike Johnson's Spine (2 replies)

- Trump says his 'own morality' is limit to his global power (3 replies)

- Pentagon seeks to reduce Sen. Mark Kelly's retirement rank over video urging troops to refuse illegal orders (2 replies)

- U.S. will look to tap Venezuelan oil reserves, Trump says (2 replies)

- Knoxville parking overhaul drives higher use, more citations, increased revenue (7 replies)

- U.S. Rep. (TN) Burchett like a child on a playground? (1 reply)

- Fear over the future of AI is valid (2 replies)

- New Tennessee laws going into effect in 2026 (1 reply)

- Winter solstice: Dec. 21, 2025 (1 reply)

TN Progressive

- Alcoa Safe Streets Plan Survey (BlountViews)

- WATCH THIS SPACE. (Left Wing Cracker)

- Report on Blount County, TN, No Kings event (BlountViews)

- America As It Is Right Now (RoaneViews)

- A friend sent this: From Captain McElwee's Tall Tales of Roane County (RoaneViews)

- The Meidas Touch (RoaneViews)

- Massive Security Breach Analysis (RoaneViews)

- (Whitescreek Journal)

- Lee's Fried Chicken in Alcoa closed (BlountViews)

- Alcoa, Hall Rd. Corridor Study meeting, July 30, 2024 (BlountViews)

- My choices in the August election (Left Wing Cracker)

- July 4, 2024 - aka The Twilight Zone (Joe Powell)

TN Politics

- Reports: US Department of Justice delivers subpoenas to Walz, Frey, Her, Ellison, Moriarty (TN Lookout)

- Nashville Councilmember Styles to challenge mayor in 2027 (TN Lookout)

- Trump says people will ‘find out’ how far he’s willing to go to acquire Greenland (TN Lookout)

- Tennessee to consider instituting tax on public EV fast chargers (TN Lookout)

- Coalition for Open Government questions law enforcement identity bill (TN Lookout)

- Immigration crackdowns impact Tennessee construction firms, survey finds (TN Lookout)

Knox TN Today

- Happy birthday, Dolly! Thank you for the gift of reading (Knox TN Today)

- Book Whisperer eagerly awaits ‘Book to Screen’ (Knox TN Today)

- Young Reader’s Shelf: The Boy in the Striped Pajamas (Knox TN Today)

- GCA vs CAK in Battle of the Bottles (Knox TN Today)

- PSCC students practice civil discourse at intercollegiate Ethics Bowl (Knox TN Today)

- Coverage of TN Scholars’ Bowl in full swing (Knox TN Today)

- HEADLINES: News and events from the World, the USA, Tennessee, Knox & Historic Notes (Knox TN Today)

- Halls, HVA are district wrestling champions (Knox TN Today)

- Bearden Bulldogs and Lady Dawgs cruise to sweep of rival Farragut (Knox TN Today)

- Tennessee football hires Indiana strength coach (Knox TN Today)

- Every SEC win matters for Lady Vols (Knox TN Today)

- James Brock: He lived along Swan Pond (Knox TN Today)

Local TV News

- Knoxville City Council OK's police program to use drones in E911 response (WATE)

- Morristown woman pleads guilty in connection to deadly overdoses (WATE)

- Smoky Mountain Children's Home gets record $6.25-million donation (WATE)

- What is the most snowfall Knoxville has seen? (WATE)

- HVAC technician urges East TN residents to check systems before wintry weather returns (WATE)

- How to keep your pipes from freezing amid winter weather threat (WATE)

News Sentinel

State News

- The Bend receives $47.5M loan with no construction timeline announced - timesfreepress.com (Times Free Press)

- Chattanooga Now Events - Arboriculture: A Comprehensive Understanding of Trees - timesfreepress.com (Times Free Press)

- Iconic Chattanooga Choo Choo train station listed for sale - timesfreepress.com (Times Free Press)

- Court date set for Chattanooga woman accused of killing man inside Hamilton Place Boulevard hotel room - timesfreepress.com (Times Free Press)

Wire Reports

- Lindsey Halligan out as U.S. attorney following pressure from judges - The Washington Post (US News)

- Air Force One Turns Back With Trump After Electrical Issue - The New York Times (US News)

- Asian Stocks Trim Losses, Japanese Bonds Rebound: Markets Wrap - Bloomberg.com (Business)

- Warren Buffett's successor eyes selling off Berkshire Hathaway's 325 million Kraft Heinz shares - AP News (Business)

- Amazon gets approval to build massive retail concept in Orland Park - chicago.suntimes.com (Business)

- Former sports reporter Michele Tafoya files to run for U.S. Senate in Minnesota - CBS News (US News)

- Minneapolis ICE shooting live updates: Grand jury subpoenas served to Gov. Walz, Mayor Frey - ABC News (US News)

- Fact Sheet: President Donald J. Trump Stops Wall Street from Competing with Main Street Homebuyers - The White House (.gov) (Business)

- Second lady Usha Vance announces she is pregnant with fourth child - BBC (US News)

- Race looms large in gun-rights arguments at Supreme Court - Politico (US News)

- Billionaire Dalio sends 2-word warning as stocks sell-off - thestreet.com (Business)

- Netflix Stock Is Tumbling. This Is Overshadowing the Streamer’s Earnings Beat. - Barron's (Business)

- Netflix updates Warner Bros bid to all-cash offer - BBC (Business)

- ‘Free America Walkout’ brings protesters to downtown Columbus in bitter cold - dispatch.com (US News)

- University of Pennsylvania Rebukes Trump Administration for Demanding Information About Jewish Staff - The New York Times (US News)

Local Media

Lost Medicaid Funding

Search and Archives

TN Progressive

Nearby:

- Blount Dems

- Herston TN Family Law

- Inside of Knoxville

- Instapundit

- Jack Lail

- Jim Stovall

- Knox Dems

- MoxCarm Blue Streak

- Outdoor Knoxville

- Pittman Properties

- Reality Me

- Stop Alcoa Parkway

Beyond:

- Nashville Scene

- Nashville Post

- Smart City Memphis

- TN Dems

- TN Journal

- TN Lookout

- Bob Stepno

- Facing South

Barry Ritholtz: "The Big Lie

Barry Ritholtz: "The Big Lie Goes Viral."